As the financial year-end approaches, businesses are presented with an opportunity to optimize their Research and Development (R&D) Tax Incentive claim. To ensure your company receives the maximum benefits from this government initiative, we have outlined some key considerations. If you’re unfamiliar with the R&D Tax Incentive or need a refresher, here’s a brief overview.

Understanding the R&D Tax Incentive

The Research & Development (R&D) Tax Incentive was introduced by the Australian Federal Government to encourage businesses to engage in research and development activities that have the potential to benefit the wider economy.

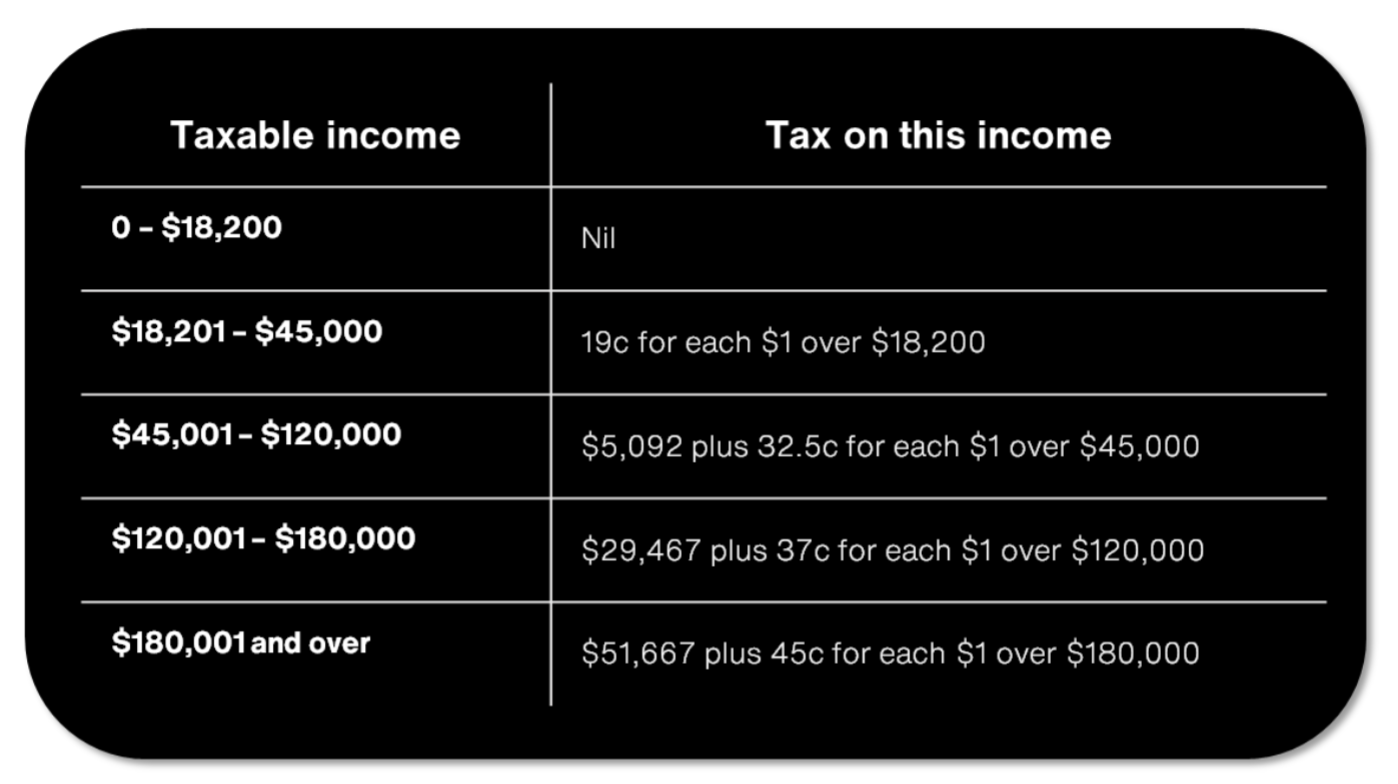

The incentive comes in the form of a tax offset, which is received upon lodgement of the tax return. The type and rate of the offset depend on the company’s aggregated turnover and R&D expenditure. Generally, companies with a turnover below $20 million are eligible for a 43.5% refundable tax offset, while those with a turnover of at least $20 million may receive a non-refundable tax offset ranging from 33.5% to 46.5%.

What Qualifies as ‘R&D’?

For the purpose of the R&D Tax Incentive, conducting at least one ‘core R&D activity’ is necessary. A core activity should encompass three key components:

1. New technical knowledge: The activity is conducted to generate new knowledge, leading to improved materials, products, devices, processes, or services.

2. Technical uncertainty: The outcome of the activity cannot be predetermined based on current knowledge or expertise.

3. Experimentation: The activity involves a systematic progression of work based on established scientific principles, leading to logical conclusions.

In addition to core R&D activities, ‘supporting R&D activities’ related to the core activity but not part of the experimentation may also be eligible. These can include preliminary research, project management, and data collection.

Am I Eligible?

To claim the R&D Tax Incentive, businesses must meet the following criteria:

1. The applicant must be an Australian tax resident company.

2. The R&D activities must be conducted in Australia.

3. The company’s eligible R&D expenditure should amount to at least $20,000 during the income year, encompassing both core and supporting R&D activities.

Eligible Expenditure

The following types of expenditure are generally eligible for the R&D Tax Incentive:

1. Employee salary and wages

2. Labour on-costs (e.g., superannuation and payroll tax)

3. Contractor expenses

4. Depreciation of plant and equipment

5. Expenditure on research service providers and cooperative research centers

6. Overhead expenses such as rent, electricity, and internet

7. Travelling expenses for technical conferences or on-site testing

Expenditure that typically does not qualify includes financing costs, sales and marketing expenses, legal and accounting fees, building construction costs, and routine business expenses.

Overseas Activities and the Incentive

In most cases, overseas activities are not eligible for the R&D tax incentive. However, there are limited circumstances where overseas R&D expenditure may qualify. To be eligible, the company must demonstrate that the overseas activity is necessary for advancing an Australian core R&D activity due to reasons other than cost and that the majority of the R&D expenditure is still incurred locally. Pre-approval through an Overseas Finding or Advance Finding is required for such activities and expenditure.

The Claiming Process

The R&D Tax Incentive is jointly administered by AusIndustry and the Australian Taxation Office (ATO). At the end of the company’s income year, an R&D application must be submitted to AusIndustry, providing details of the core and supporting activities

conducted. The application deadline is usually 10 months after the end of the income year, such as April 30th for companies with a June 30th year-end.

Once the application is processed by AusIndustry, a registration number is issued, which is then entered into the company’s income tax return. The ATO applies the R&D tax offset against the company’s income tax liability, reducing the overall tax burden or resulting in a tax refund.

Maintaining Documentation

Companies must keep contemporaneous documentation of the core and supporting R&D activities throughout the income year. Two types of documentation are essential: expenditure documentation and R&D activities documentation.

Expenditure documentation should demonstrate how the claimed expenditure is directly related to the R&D activities, including invoices, asset registers, accounting records, and employee timesheets.

R&D activities documentation should establish that the claimed activities meet the requirements of a core or supporting activity. This can include project plans, lab results, progress reports, before-and-after photos, and enterprise management software records.

Review and Audit Process

Both AusIndustry and the ATO have the authority to review or audit an R&D claim. The claim can be reviewed up to four years after lodgement of the company tax return (by the ATO) or four years after the relevant income year ends (by AusIndustry). It is crucial to maintain R&D records for a minimum of five years to satisfy audit requirements.

Coexistence with Other Government Grants

It is possible to claim the R&D Tax Incentive while also receiving other government grants. However, adjustments may be required for R&D expenditure claimed under grants such as JobKeeper, JobSaver, the Accelerated Commercialisation Grant, or the MVP Grant.

Preparation Before Year-End

To maximize your R&D claim, consider these steps before the year-end:

1. Settle any outstanding employee superannuation liabilities.

2. Prepay expenses.

3. Clear any amounts owed to associates.

4. Opt for appropriate depreciation rates, such as those available under the Temporary Full Expensing provisions.

5. If you plan to claim overseas expenditure, submit the application with AusIndustry before the income year ends.

R&D Tax Incentive for Research Service Providers

As a research service provider conducting R&D activities on behalf of another entity, the proper claimant of the R&D Tax Incentive generally meets the following criteria:

1. Owns or has rights to exploit any intellectual property or know-how generated from the R&D activities.

2. Bears the financial risk associated with the R&D activities.

3. Controls and conducts the R&D activities.

Income Tax Consolidated Groups

For R&D activities conducted by entities within an income tax consolidated group or MEC group, only one R&D Application is submitted to AusIndustry by the group’s head company on behalf of all members.

Expanding Business Operations to Australia

Multinational corporations conducting R&D activities in Australia must meet standard eligibility criteria and may require written agreements in place before commencing those activities. The nature of these agreements depends on the corporate structure and IP ownership resulting from the R&D activities.

Interaction with Other Tax Provisions

Since the R&D scheme offers a tax incentive, it can impact other aspects of income tax, including franking accounts, transfer pricing, commercial debt forgiveness, and the small business instant asset write-off. Hence, comprehensive R&D and tax advice is recommended.

For more information on these considerations and other relevant details, please reach out to your Corporate Advantage R&D Tax Specialist.