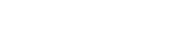

Australian Resident Personal Income Tax Rates for 2023-24

As we commence the new year following the festive season, it’s timely to consider the personal income tax rates for the 2023-24 financial year, which remain consistent with the previous years. In the context of current economic pressures, it’s understandable to question the comparative tax burdens on individuals and corporations.

The tax rates for Australian residents for 2023-24 are structured as follows:

Looking ahead, the Stage 3 tax cuts set for implementation from 1 July 2024 are anticipated to bring significant changes. These include reducing the 32.5% tax rate to 30% for incomes between $45,000 and $200,000 and abolishing the 37% tax bracket. Consequently, the tax structure for the 2024-25 financial year will predominantly feature three tax rates: 19%, 30%, and 45%. This shift is expected to align personal income tax more closely with corporate tax rates, affecting a substantial proportion of Australian taxpayers.

For the 2024-25 financial year, the tax brackets will be structured as follows:

Please note that the figures do not include the 2% Medicare Levy.